-

I founded Euronet with a mission to bring financial payment inclusion to those who have not had it before. To this end, we’ve worked relentlessly since 1994 to further this mission and now have customers in approximately 190 countries and territories with employees in 56 countries and 66 business offices around the globe. We have achieved this global scale through the valued perspectives of our ethnically diverse and gender diverse workforce. The content below highlights the environmental, social, and governance achievements across our organization and I am proud of the culture we have fostered to deliver:

- Products and services that consume very few natural resources, fossil fuels, or environmentally damaging byproducts;

- Technologies that enable our customers to bridge financial imbalances across the globe and provide financial inclusion to those who may not otherwise have the opportunity to participate;

- and a corporate governance structure that is designed to elevate a workforce capable of delivering these results to customers through industry leading practices.

In summary, I believe our products and services have a long runway to continue providing positive environmental and social change into the future, protected by our strong corporate governance structure.- Michael J. Brown

-

We are an industry-leader in processing secure transactions and developing leading-edge payments technologies.

Founded in 1994, our processing capabilities started with a single ATM in Budapest, Hungary. From there, we evolved to processing 16-digit card numbers at POS terminals all the way to the present digital era where our multiple worldwide data centers process billions of transactions each year.

Given our volume and global presence, our data centers must process a wide variety of transactions with any number of payment types, including digital-to-cash, cash-to-digital, card based, dynamic digital codes, cross border, multiple currencies and real time settlements.

-

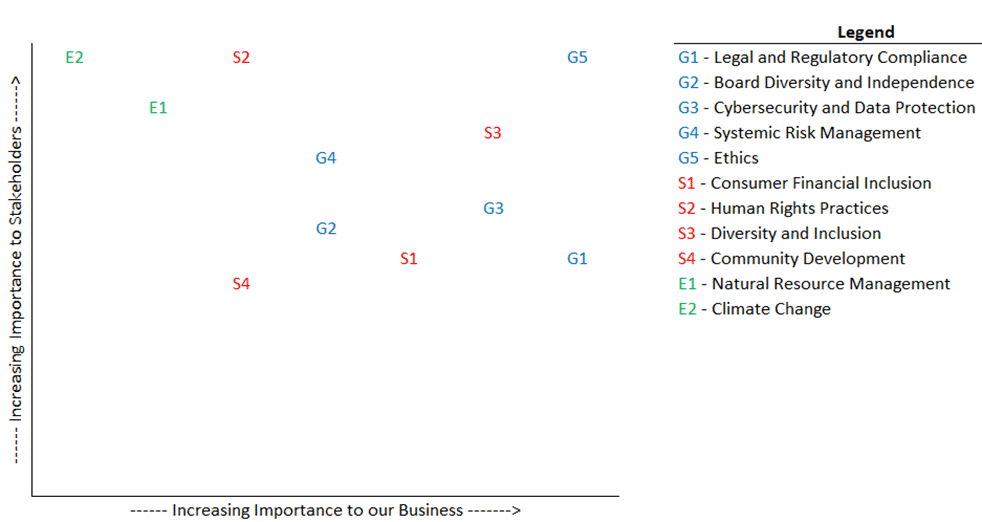

Materiality Assessment

In 2021, we performed a materiality assessment as the foundation for evaluating ESG across the organization. Through this process, we utilized a matrix that graphs relative importance of ESG topics to our stakeholders and our business success. The issues raised by our stakeholders are plotted in increasing importance across the Y axis, with our stakeholders being identified as our employees, customers, suppliers, communities, investors, and the environment. Stakeholders are encouraged to reach out to irelations@euronetworldwide.com to address their inputs. Our business success, plotted in increasing importance across the X axis, was identified as our long-term ability to continue providing innovative products and services to our customers.

During the scoping phase of the materiality assessment, we consolidated material topics and identified 11 ESG topics that most directly impact our stakeholders and business. We identified many areas where the magnitude of the impact to stakeholders was material, but the impact to the business was not relevant to the industry we operate in (for example, hazardous waste handling). In these scenarios, we strive to advance the best interests of all stakeholders when applicable, but these efforts are not documented below because they are not material in or to our business.

Governance

G1 – Legal and Regulatory Compliance – This includes our ability to maintain compliance with a wide variety of complex laws and regulations from both the U.S. and foreign governments.

G2 – Board Diversity and Independence – This includes the performance of our Board through the collaboration of unique perspectives by individuals of varying tenures, genders, ethnic backgrounds, geographies, and professional experiences.

G3 – Cybersecurity and Data Protection – This includes our ability to operate a secure network that protects personal and financial information.

G4 – Systematic Risk Management – This includes our ability to adapt to evolving threats to our business model.

G5 – Ethics – This includes our ability to uphold our high ethical business standards and behaviors.

Social

S1 – Consumer Financial Inclusion – This includes providing access to finance for the unbanked and underbanked population.

S2 – Human Rights Practices – This includes protecting the fundamental human rights that our employees, customers, and business partners are entitled to.

S3 – Diversity and Inclusion – This includes the ability for all people, regardless of differences in social or physical traits, to access our products and services, to work for us, to partner with us, or to invest in us.

S4 – Community Development – This includes using our resources to advance the communities in which we operate.

Environmental

E1 – Natural Resource Management – This includes our efforts to reduce, re-use, and recycle the limited natural resources our planet provides us.

E2 – Climate Change – This includes our ability to influence GHG and non-GHG emissions from operations, employee travel, and customer travel.

Using the materiality assessment as a tool to focus managerial attention to the most material topics for our stakeholders and business, management designed a three-pillar approach of policy creation, measurement, and action to advancing each of the 11 topics.

-

We are an industry-leader in processing secure transactions and developing leading-edge payments technologies. As such, our revenues are primarily derived from offering these electronic services, rather than through the production and sale of goods. Other than the fossil fuels, timber, and water resources used to generate heating, air conditioning or sanitation management required to operate our office operations, retail locations and ATMs, our operating activities generally do not involve the consumption of fossil fuels, timbers or water. Although our impact on the environment is minimal for a company of our size, we are committed to maintaining a low impact wherever possible. Accordingly, we encourage our suppliers of office facilities to adopt environmentally efficient standards.

What we do:

- Include environmental and social factors when evaluating whether to partner with suppliers and vendors.

- Optimize our networks to efficiently utilize hardware and power components.

- Incorporate sustainable initiatives into our management plans and vendor and service provider agreements.

- Enable the elimination of paper receipts, invoices or resource consuming activities.

What we don’t do:

- Produce products from natural resources such as fossil fuels, timber, water and rare-earth minerals.

- Manufacture products or purchase products from exploited labor markets.

- Participate in any mining, forestry, power generation or water sourcing.

- Promote activities that are detrimental to environmental or social best practices.

- Operate processes that produce environmentally impacting byproducts.

We recognize the 17 Sustainable Development Goals that are established in the United Nation’s 2030 Agenda for Sustainable Development as the basis for developing our enterprise level environmental policies and practices and it is our practice to hold suppliers to the same standards. Based on our operations, significant salient risks identified in our impact to the environment include electricity usage to power the systems we operate, electronic waste and forestry conservation efforts. Our primary mitigation of these risks include the seasonal deactivation of ATMs (to conserve electricity), transition to digital money transfers and digital distribution of epay content (reducing carbon footprint of customer travel to merchant stores), digital receipts of ATM withdrawals and deposits (to conserve paper) and energy efficient devices used within corporate offices (to reduce our carbon footprint). As a result of these efforts, we can contribute to addressing the planets rise in core temperature by reducing the addition of CO2 from operations and work towards the United Nations Intergovernmental Panel on Climate Change (IPCC) target of limiting global warming to 1.5° Celsius. The environmental policies established are ultimately under the direction of the Chief Executive Officer and the Board of Directors. The Board of Directors is responsible for reviewing our risk factors as identified in the annual report on Form 10-K, inclusive of material risk factors that impact the environment. We believe in continuous improvement and will continue to target enterprise level improvements that can decrease the environmental impact of our operations.

Additionally, our software systems are designed to rely on less hardware to prevent electronic waste, and when applicable, our practice is to dispose of electronic waste using e-waste recyclers as defined by the Basel Action Network. We design our computer system and networks for distributed processing and load balancing, enabling the elimination of back-up centers consuming significant resources. Prior to the disposal of waste, we prioritize the re-use of goods, then prioritize the recycling of goods and lastly will dispose of the goods if there are not acceptable alternative methods of disposal. Due to the nature of our operations, we do not typically produce or handle hazardous waste.

Positive environmental impacts

- Our ATMs have the capability for customers and merchants to fill the ATM with cash and reduce travel to bank branches.

- Our epay electronic payment solutions enables digital distribution of content to eliminate travel to merchant stores.

- Our Money Transfer segment provides digital remittance solutions to eliminate travel requirements of sending cash.

-

We value the fundamental protection of human rights, consistent with the Universal Declaration of Human Rights. This view extends to all employees in our operations across all geographies in which we operate, which includes women and minority groups. We have a responsibility to apply these high ethical standards to our operations, suppliers, vendors and partners. We also recognize that we have a responsibility to encourage our partners to protect fundamental human rights in accordance with our high standards and are open to policy improvements proposed by stakeholders. Ultimately, our Board of Directors is responsible for Human Rights directives, which are evaluated annually and incorporate employee satisfaction surveys when applicable.

Specifically, we are committed to the following principles on behalf of our employees, and seek to do business with suppliers and vendors that share these principles to the extent possible:

- Having zero tolerance of forced labor

- Ensuring a fundamental right to water

- Ensuring the right to privacy

- Ensuring the freedom of expression

- Eliminating discrimination based on gender identity or gender expression

- Providing a living wage for all employees

- Promoting customer and employee data protection, including cyber-security

- Promoting anti-bribery and anti-corruption practices

We are committed to advancing the diversity of our workforce across all geographies and levels of management, inclusive of race, ethnicity and gender diversity. Our policies specifically prohibit hiring and promotion activities from considering race, ethnicity, or gender and these anti-discrimination policies are applicable to the selection of members of our Board of Directors. Additionally, the Board believes that its membership should continue to reflect a diversity of gender, race, ethnicity, age, sexual orientation and gender identity and the Nominating/Governance Committee is committed to actively seeking women and minority candidates for the pool from which director candidates are chosen in support of the Board’s commitment to diversity.

The below examples highlight just a select few of the positive instances of how we are driving social initiatives across the globe.

Employee Diversity

We are committed to advancing diversity and inclusion, specifically diversity and inclusion of genders and ethnicities across our organization. Our efforts towards advancing gender equalities are consistent with those outlined in SDG 5, Gender Equalities, and we are well positioned to succeed on this goal as we have a strong tradition of gender equality with females representing more than 46% of our workforce. Additionally, approximately 19% of our workforce is located in the United States, which is largely consistent with our global footprint as more than two-thirds of our revenues are denominated in currencies other than the U.S. dollar. The wide range of ethnicities across our workforce collaborate to enhance our work environments which leads to the creation of industry leading products and services engrained with the unique perspectives provided by each ethnicity. Our achievements wouldn’t be possible without the unique blend of ethnicities within our workforce.

ATM Idle Screen Utilization

Consistent with the goals outlined in SDG 10, Reduced Inequalities, we are passionate about reducing inequalities, as we partner with organizations such as UNICEF Croatia on the occasion of the 30-year anniversary of the Convention of the Rights of the Child. Our ATM estate in Croatia leveraged the ATM idle screens to promote consumer awareness towards UNICEF Croatia’s CRC30 campaign. Additionally, in Germany we supported Deutsch Cleft Kinderhilfe which provides comprehensive help to children with cleft lips and palates across the world. Our ATM idle screens are utilized to drive campaign awareness and contributions that will reduce inequalities and suffering which are designed to provide a bright and equal future for the children of the world.

Ria Remittance Cost Reduction

The UN established a target to lower the average cost of remittance services globally 3% by the year 2030 and Ria is at the forefront of this effort as we lead the industry in leveraging our technology and global partnerships to provide customers with transparent and advantageous fees. Our services enable the significant population of ex-patriates and immigrant communities to remit funds to family and friends in their home country to advance their home economies and work to eliminate poverty consistent with SDG 1, No Poverty. In addition to the cost advantages that our portfolio of Money Transfer services provides, we also provide customers with technologies that enable digital remittances, which can further reduce the economic burden on customers as they can now skip trips to cash pickup sites. The majority of our remittances are sent to developing countries with higher instances of poverty.

Employee Training

Our employees regularly complete training to advance topics such as AML training and cybersecurity awareness. Our training programs ensure that our workforce is well trained so that they are enabled to advance their careers in accordance with SDG 8, Decent Work and Economic Growth. Additionally, we offer employees the following transition assistance programs in certain markets in which we employ our workforce. As an organization we prioritize the retention of our employees, as evidenced during the COVID-19 pandemic and our ability to continue operations through the pandemic without a workforce reduction. We achieve this through tuition reimbursement programs, pre-retirement planning, counseling programs, and sabbatical leave programs. To assist in our assessment of workforce quality, we regularly undertake performance reviews and career development reviews, and we routinely evaluate market wages and make adjustments where we find appropriate.

Architectural and Cultural Preservation

We value the historical and architectural legacy of cities and want to make sure that our ATMs can be fully immersed in the surroundings, while serving the cash access needs of consumers. By designing our products and services to compliment the surrounding culture and heritage of our consumers we are able to drive community engagement through fostering the respect needed to work together in local communities.

Amber Alerts Europe

We established a pan-European partnership with Amber Alerts Europe to publish active alerts for missing children and awareness campaigns on our ATM screens. These initiatives are currently active in five countries and have directly led to finding 12 lost people in the first two years of implementation. The successful deployment of Amber and missing person alerts aligns with our mission to further SDG 17, Partnerships for the Goals, as our efforts require partnerships with local NGO’s and national authorities. Our ability to further SDG 17 is enhanced when we align the goals of communities with our resources to create mutual benefits to society.

ATMs in the Community

We established our ATMs in the Community program in 2020 with the goal of providing access to cash for people who live far from large urban centers and furthers SDG 11, Sustainable Cities and Communities. The need for ATMs in these areas has steadily increased the last 10 years across Europe as banks reduced their commercial networks by 40% and closed remote bank branches because of economic issues and mergers. In Spain, for example, 50% of Catalan municipalities do not have a bank branch according to the latest data from the Bank of Spain and the INE. As an independent ATM provider, we decided to fill the vacancies left behind by the traditional banks with the launch of this European-wide program that ensures citizens and businesses in these communities can safely and easily access cash, without needing to travel long distances, thus decreasing extra costs and time.

Days of Caring

We have a passion for supporting local communities that is driven by the donation of time and talents of our diverse workforce. We encourage all our employees to give back to their communities across approximately 190 countries and territories where we operate. Our employees undertake “Euronet Days of Caring” that target local community partnerships to support causes our local teams believe are important to enhancing the lives of others in their community. A few of our local community causes include our team in Hungary renovating a playground at the local orphanage, our team in Croatia sponsoring the Terry Fox Run to support cancer research, and our team in Germany renovating an elementary school. In 2021, this amounted to approximately 64,000 hours, or approximately $18 million, invested directly in the communities where we do business.

Positive Office Environment

An extension of our general human rights practices is our employees’ rights to good health and well-being in a healthy workplace environment consistent with SDG 3, Good Health and Well Being. Our office environment includes:

- Additional employee assistance under the Families First Coronavirus Response Act (FFRCA) to provide employer paid leave to care for families.

- Food programs to provide nutritional guidance on healthy fruits, grains and vegetables to replace unhealthy alternatives.

- Work-from-home benefits to assist employees in the transition to work-from-home during the COVID-19 pandemic.

Financial Education

Our EFT business operates a website dedicated to financial education matters that is accessible to both our employees and our customers. The data promoted on this platform drives our commitment to SDG 4, Quality Education.

Other Positive Social Impacts:

- Our Money Transfer segment promotes financial literacy through bill payment services and providing access to cash for the unbanked and underbanked.

- Our Money Transfer segment’s cross border capabilities enable the advancement of foreign remittances to developing economies and to family members in need, which can dramatically improve their quality of life.

- We produce and distribute financial products that promote financial inclusion.

- We provide financial contributions to numerous charities.

- We provide free money transfers to certain regions in disaster situations.

- We provide fraud detection to prevent elderly or vulnerable groups from being preyed upon.

- We make thousands of jobs available to people in lesser developed economies that might not otherwise have employment opportunities at compensation levels that generally exceed the respective country’s average personal income based on the World Bank’s global per capita income data.

Over the past year our commitment to the social well being of our employees included, but not limited to, the following:

- Throughout the pandemic we did not terminate employees to cover profit short falls. Rather, our commitment to our employees saw our total salaries and benefits increase 9% while our operating profits dropped by nearly 75%.

- We provided medical assistance and medical equipment to our employees in under-developed markets which had inferior medical practices or facilities.

- We provide free money transfer services to people sending money to Ukraine to support family and friends during the recent conflict.

- We provided free ATM withdrawal services to people fleeing Ukraine amidst the Russian invasion.

- We continued to pay our employees in Ukraine despite the complete shut down of ATM operations in Ukraine.

-

Political Contributions

In compliance with our Political Contribution Policy, we do not use corporate funds to contribute to candidates, political party committees, political action committees, or Super PACs. Employees are prohibited from making political contributions on behalf of the organization. Read more about our Political Contribution Policy on our Investor Relations website.

Board of Directors

Board oversight of ESG

In 2021, the Board of Directors expanded the Nominating and Governance Committee to include ESG. The inclusion of ESG within this committee is focused on driving intentional considerations for ESG related matters and acknowledging the Board’s responsibility for ESG in the organization. In addition to ESG being at the forefront of the highest governing body in the organization, there are also sub-committees composed of ESG management throughout the organization, including representatives from legal, finance, accounting, marketing, human resources, and operations as well as representation from our offices globally.

Diversity

Our Board of Directors are highly accomplished individuals in their respective industries, fields and communities which are affiliated with numerous corporations, educational institutions, and charities, as well as civic organizations and professional organizations.

Board Diversity Matrix as of December 31, 2021

Total Number of Directors: 8Female Male Non-Binary Did Not Disclose Gender Part I: Gender Identity Directors 1 7 - - Part II: Demographic Background African American or Black - - - - Alaskan Native or Native American - - - - Asian - - - - Hispanic or Latinx - - - - Native Hawaiian or Pacific Islander - - - - White 1 7 - - Two or More Races or Ethnicities - - - - LGBTQ+ - - Did Not Disclose Demographic Background - - The Board evaluated the NASDAQ diversity rule noting each of the current Board members were elected prior to the SEC approval of the NASDAQ Board Diversity Rule. The Nominating and Corporate Governance Committee performs extensive evaluations of the credibility of each Board member and did not exclude a Board candidate based on their gender identity or demographic background. The Board of Directors have ethnic diversity beyond the specific ethnicities defined in NASDAQ Rule 5606, with representation from within and outside the United States, as well as a diverse background of industry experiences ranging from entrepreneurship, finance, transportation, technology, government, academia, and communications. Our Board includes CEOs, patent owners, MIT engineers, Molecular and Cellular Biologists, Ph.Ds, MBAs, and CPAs, all delivering insights from their unique and diverse histories.

In December 2021 the Board adopted a requirement that candidates of gender and racial or ethnic diversity are sought out and included in its director search processes, commonly known as the “Rooney Rule.” In May 2022, the Board decided, and publicly disclosed, to go further and has committed to nominating a racially or ethnically diverse nominee for election at the 2023 Annual Meeting of Stockholders or appointing such a diverse individual to our board sooner.

Knowledge and Skills

The Board of Directors has decades of experience across a wide array of industries and markets. The knowledge and skills acquired by our Board of Directors include the formation of ground-breaking software technologies, successful company launches, critical contributions to local non-profit organizations, and business transformations.

Michael J.

BrownPaul S.

AlthasenMark R.

CallegariMichael N.

FrumkinThomas A.

McDonnellDr. Andrzej

OlechowskiAndrew B.

SchmittM. Jeannine

StrandjordIndustry Experience X X X Executive Management Experience X X X X X X X X Knowledge of Public Policy X Governmental Affairs X X Accounting / Finance X X X X Strategy X X X X X X X X Marketing X X X Information Technology X X X Public Relations X Risk Management X X X X X X X X Independence

The Board of Directors has determined that all of the non-employee Directors are “independent” under the listing standards of The Nasdaq Stock Market LLC. In the event of Board-level discussions pertaining to a potential transaction, relationship or arrangement involving an organization with which a Director is affiliated, that Director would be expected to recuse himself or herself from the deliberation and decision-making process.

Cybersecurity

In addition to the consumer financial information that we safeguard, our cybersecurity and data protection are at the core of our portfolio of products and services. Our REN product platform is designed to be one of the most scalable, stable and secure real time payment platform on the market. The security of our systems is based on a blend of engineered architecture to prevent system breaches together with continued employee training to keep our cybersecurity programs up to date. During 2021, we had no material substantiated complaints concerning breaches of customer privacy and losses of customer data. This continues our strong track record of security that enables our software solutions to be marketable for future additional customers.

Code of Business Conduct and Ethics

We believe a great company can only be built on a solid ethical foundation. To formally document our commitment to these principles, the Board of Directors adopted our Code of Business Conduct and Ethics in December 2019. The full document can be found on our investor relation website. Additionally, we maintain an ethics hotline at +1-792-708-5030 and hotline@eeft.com to field anonymous and confidential inquiries into potential ethical violations. We strictly prohibit retaliation against any person who provides a report made in good faith concerning a possible violation of any law or our Code of Business Conduct and Ethics.

Innovation

A critical component of our industry leading legal and regulatory compliance framework is rooted in the design of the systems we operate. For example, the development of our real-time payment network which allows us to connect with over 3.6 billion bank accounts, includes the system logic to comply with approximately 175 countries financial regulations to complete the transactions. Our proprietary design of our real-time payment network, combined with the foresight to build legal and regulatory compliance controls into our software, has enabled us to avoid material regulatory fines and penalties. This is just one example of how we leverage SDG 9, Industry, Innovation and Infrastructure, in order to meet the increasingly complex legal and regulatory compliance environments in which we operate. We operate in more than 100 states or countries that require licenses for processing of transactions in compliance with unique anti-money laundering and anti-terrorism requirements.

Another example of our industry leading software’s ability to meet legal and regulatory compliance matters across the globe is our development and implementation of our REN foundation to power Mozambique’s National Payments Network in November 2020. Our software is key in assuring the smooth payment processing required for the country of Mozambique to be included in a modern financial system, consistent with goals outlined in SDG 16, Peace, Justice and Strong Institutions.

-

We are committed to protecting the environment, making the businesses and communities we work in a better place to work, leading to a better standard of living which is inclusive to all and governing with proper attention to risks, ethics, and ESG matters for our stakeholders.

Side Nav

- Overview

- Corporate Governance

- Financial News

- Events & Presentations

- Financial Information

- ESG

- Stock Information

- Analyst Coverage

- Contact Investor Relations

Euronet’s Commitment to Sustainability Through Responsible Environmental, Social and Governance Practices

-

I founded Euronet with a mission to bring financial payment inclusion to those who have not had it before. To this end, we’ve worked relentlessly since 1994 to further this mission and now have customers in approximately 190 countries and territories with employees in 56 countries and 66 business offices around the globe. We have achieved this global scale through the valued perspectives of our ethnically diverse and gender diverse workforce. The content below highlights the environmental, social, and governance achievements across our organization and I am proud of the culture we have fostered to deliver:

- Products and services that consume very few natural resources, fossil fuels, or environmentally damaging byproducts;

- Technologies that enable our customers to bridge financial imbalances across the globe and provide financial inclusion to those who may not otherwise have the opportunity to participate;

- and a corporate governance structure that is designed to elevate a workforce capable of delivering these results to customers through industry leading practices.

In summary, I believe our products and services have a long runway to continue providing positive environmental and social change into the future, protected by our strong corporate governance structure.- Michael J. Brown